- Used car financing in Manitoba is the process of securing a loan, typically through a dealership, bank, or credit union, to cover the purchase price of a pre-owned vehicle, which is then repaid with interest over a fixed term. To successfully navigate this process in Winnipeg and rural Manitoba, buyers must understand their credit score, provide proof of income, and ensure the vehicle has a valid Certificate of Inspection (COI). Unlike a simple cash transaction, financing requires navigating specific regulations under the Manitoba Consumer Protection Act to ensure transparency and affordability.

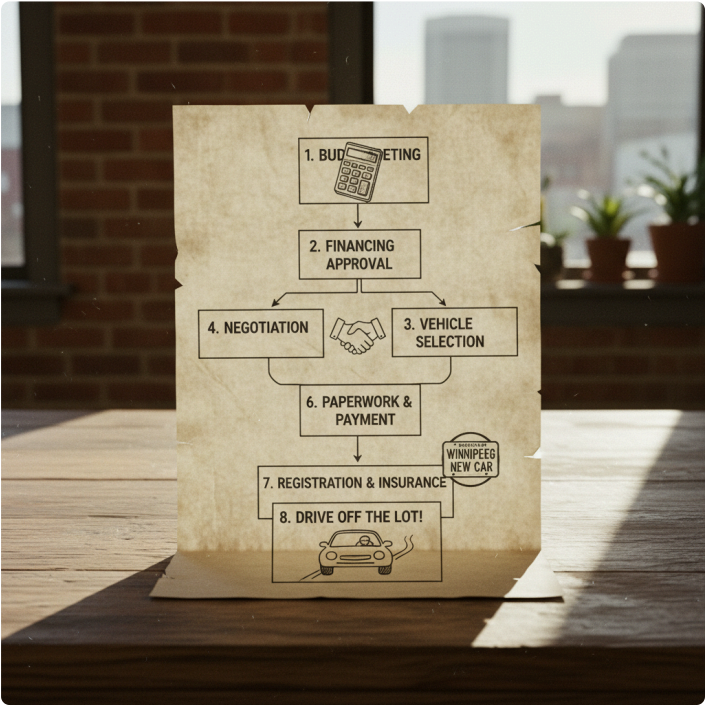

Quick Summary: How to Get a Used Car

Loan in Manitoba (The Direct Answer)

If you are looking for the fastest route to getting behind the wheel, here is the condensed

roadmap for Manitoba buyers:

- Assess Affordability: Calculate your budget, factoring in high interest rates and insurance.

- Check Your Credit: Know your score before you walk into a dealership.

- Get Pre-Approved: Apply online with dealerships or brokers to lock in a rate.

- Select a Certified Vehicle: Ensure the car has a passed COI (Certificate of Inspection).

- Finalize Paperwork: Sign the Bill of Sale and Transfer of Ownership Document (TOD).

- Register with MPI: Take your documents to an Autopac agent to get plates and insurance.

The 5 Critical Steps to Approval in

Winnipeg and Rural MB

Securing approval for a vehicle in Manitoba is straightforward if you follow a structured

approach. Whether you are in downtown Winnipeg or outside the Perimeter in rural communities, the fundamental criteria for approval remain consistent: capacity to pay, credit

history, and vehicle value.

The landscape has changed in 2025. Lenders are more rigorous regarding income verification,

but there are also more options available for non-prime borrowers. Following these five steps

will help you avoid rejection and secure the best possible terms.

Data Breakdown: Typical Interest Rates and

Terms for 2025

Before diving into the steps, it is vital to understand what a “good” deal looks like in the

current economic climate. Interest rates fluctuate based on the Bank of Canada’s prime rate

and your individual credit risk.

Below is a breakdown of typical rates you might encounter in Manitoba for used vehicle

financing this year:

| Credit Tier | Credit Score Range | Est. Interest Rate (APR) | Typical Loan Term |

| Prime | 720 – 850 | 6.99% – 8.99% | 48 – 72 Months |

| Standard | 660 – 719 | 8.99% – 11.99% | 60 – 84 Months |

| Non-Prime | 600 – 659 | 10.99% – 16.99% | 48 – 72 Months |

| Subprime | 300 – 599 | 17.99% – 29.99% | 36 – 60 Months |

Step 1: Analyzing Your Budget and The True

Cost of Ownership

Many buyers make the mistake of focusing solely on the monthly payment. However, the

sticker price is just the tip of the iceberg. In Manitoba, the true cost of ownership includes

distinct local variables that can impact your wallet significantly.

Using a Payment Calculator to Determine Affordability

Before falling in love with a specific truck or sedan, you must run the numbers. A general rule

of thumb is that your car payment should not exceed 15-20% of your take-home pay.

To get an accurate estimate of what your monthly or bi-weekly obligation will look like, you

should utilize a Payment Calculator. This tool allows you to input the interest rate and term

length to see if the financing aligns with your monthly cash flow.

Factoring in Insurance, Fuel, and Manitoba Winter

Maintenance

Living in Manitoba means dealing with extreme weather, which directly affects vehicle costs.

You must account for:

- MPI Premiums: Manitoba Public Insurance rates vary based on your driving record and where you live (Winnipeg vs. Rural).

- Winter Tires: A necessity, not a luxury. Budget $800-$1,200 every few years.

- Fuel Consumption: Remote car starters and winter idling increase fuel consumption.

For a deeper dive into these hidden expenses, read about The True Cost of Used Car

Ownership in Winnipeg: Beyond the Sticker Price.

Step 2: Understanding Credit Requirements

in Manitoba

Your credit score is the gatekeeper to favorable financing terms. Lenders in Manitoba use this

three-digit number to determine the risk of lending to you.

What Credit Score is Needed for a Used Car Loan in

Manitoba?

Generally, a score above 660 allows you to access standard interest rates through major

banks. A score above 720 unlocks “Prime” rates, which are the lowest available. However, you

can still get approved with lower scores; you will simply face higher interest rates to offset the

lender’s risk.

For a broader perspective on approval criteria, you can review external resources on How to

Get Approved for Vehicle Financing in Manitoba.

Used Car Financing Options for Bad Credit or No Credit

History

If your score is below 600, or if you are a newcomer to Canada with no credit history, you are

not out of luck. Many dealerships specialize in “subprime” financing. They look beyond the

score to your income stability and debt-to-income ratio.

To explore specific options for difficult credit situations, check out Car Financing Available In

Winnipeg, MB – Hiru Auto. These programs focus on your ability to pay today rather than

your financial history from years ago.

Step 3: Comparing Lenders (Dealerships vs.

Banks vs. Private)

Where you get your loan is just as important as the car you buy. In Manitoba, you primarily

have three options: dealership financing, direct bank loans, or third-party brokers.

Why Dealership Used Car Financing Offers Streamlined

Approval

Dealerships are often the most convenient option because they handle the vehicle sale and

the financing in one transaction. They have relationships with multiple lenders, allowing them

to “shop” your application to find the best rate.

If you are looking for reputable places to start your search, consider reviewing Unveiling

Winnipeg’s Top 7 Used Car Dealerships: Your Ultimate 2025 Guide.

The Role of Third-Party Brokers like Epic Financial

For buyers with unique financial situations, third-party brokers can be a lifesaver. Companies

like Epic Financial specialize in connecting borrowers with lenders that traditional banks

might overlook.

Financing with Epic Financial can be particularly beneficial if you are self-employed or have a

history of bankruptcy, as they often have access to non-traditional lenders.

Pros and Cons of Bank Loans for Used Vehicles

- Pros: Lower interest rates for existing customers; you walk into the dealership with a cheque in hand (cash buyer leverage).

- Cons: Stricter approval criteria; longer processing times; usually refuse to finance older vehicles (typically 7-10 years max).

Step 4: Gathering Essential Documents for

Approval

Speed up your approval process by having your paperwork ready. Lenders will pause your

application if they have to chase you for documents.

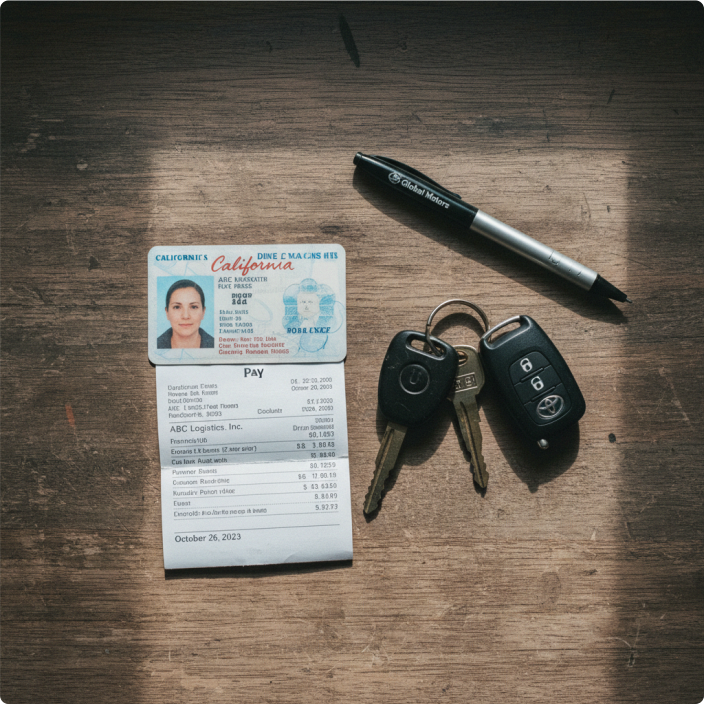

Checklist: Income Verification, ID, and Residence Proof

To secure a loan in Manitoba, you typically need to provide the following:

- Valid Driver’s License: Must be valid in Manitoba.

- Proof of Income: Two recent pay stubs or 3 months of bank statements.

- Proof of Residence: A utility bill or lease agreement matching your ID address.

- Void Cheque: For setting up pre-authorized payments.

For a detailed archive of necessary paperwork, refer to What documents needed to buy used

car Manitoba Archives.

Specific Requirements for ‘No Credit’ Used Car Loans

If you have no credit, lenders will weigh your employment history heavily. Expect to provide a

Letter of Employment and possibly references who can vouch for your stability. A larger

down payment is often required to secure approval in these scenarios.

Step 5: Selecting the Right Vehicle and

Navigating Regulations

Once financing is secured, the fun part begins: choosing your car. However, Manitoba has

strict regulations to protect buyers.

The Importance of a Valid Certificate of Inspection (COI)

In Manitoba, a used vehicle cannot be registered without a valid Certificate of Inspection

(COI). This safety check ensures the brakes, suspension, and tires meet provincial standards.

When browsing High Quality Used Cars for Sale, always verify the status of the COI.

Navigating Manitoba Regulations and The Consumer

Protection Act

Dealers must disclose specific information about the vehicle’s history. This is mandated by the

government to prevent fraud. For a comprehensive look at what to watch out for, read The

Ultimate Canadian Used Car Buyer’s Checklist: Navigating Manitoba Regulations.

Additionally, the government provides Important Tips on Buying a Vehicle regarding required

disclosures, such as past collision damage or if the car was previously a rental.

Why You Must Perform a Lien Check Before Private

Financing

If you are buying privately and getting a bank loan, you must perform a lien check. If the

previous owner owes money on the car, the debt stays with the vehicle. If they stop paying,

the lender can repossess your new car.

Expert Analysis: The MPI Integration Gap

A common point of confusion for Manitoba buyers is the relationship between their financing

and Manitoba Public Insurance (MPI).

How Financing Affects Your Manitoba Public Insurance

(MPI) Registration

MPI is the insurance provider, not the lender. However, when you register the vehicle, you

must present the Bill of Sale. If you have financed the vehicle, the lender will register a lien

against it in the Personal Property Registry. MPI does not enforce loan payments, but you

cannot transfer the title to someone else later without clearing that lien.

Completing the Transfer of Ownership Document (TOD)

with a Lien

The Transfer of Ownership Document (TOD) is on the back of the vehicle registration card.

Both the buyer and seller must sign this. Ensure the date on the TOD matches your Bill of Sale

and financing agreement to avoid administrative headaches at the Autopac counter.

Conclusion: Taking the Next Step Toward

Your Vehicle

Navigating used car financing in Manitoba does not have to be stressful. By analyzing your

budget, checking your credit, and understanding the documentation required, you can walk

onto the lot with confidence.

Booking a Test Drive in Winnipeg

Now that you are armed with financial knowledge, it is time to get behind the wheel. The feel

of the car is just as important as the numbers on the contract. We recommend that you Test

Drive a Vehicle in Winnipeg to ensure it handles our unique road conditions to your

satisfaction.

Frequently Asked Questions About Manitoba Car Loans

- Q: Can I get a car loan while on Employment Insurance (EI)?*

A: It is difficult but possible with specialized subprime lenders who consider the temporary nature of EI.

- Q: How long is a COI valid for?*

A: A Certificate of Inspection is valid for one year from the date of inspection.

- Q: Does checking my own credit hurt my score?*

A: No. Checking your own score is a “soft inquiry” and has no impact. Applying for a loan

results in a “hard inquiry,” which can temporarily lower your score.