Key Takeaway

Buying a used car in Manitoba requires navigating strict provincial regulations including the Certificate of Inspection (COI), Retail Sales Tax (RST), and Autopac registration.

- Mandatory Safety: A valid COI is required for registration and lasts one year.

- Tax Rules: Private sales attract 7% RST; dealer sales charge 5% GST and 7% PST.

- Documentation: You must have a Transfer of Ownership Document (TOD) and Bill of Sale.

- Price Context: The average used car price in Canada is approximately $34,445.

Continue reading for the complete 7-step checklist to ensure a safe and legal vehicle purchase.

How Do You Navigate the Manitoba Used Car Market?

Navigating the Manitoba used car market requires understanding three core pillars: legal documentation, tax obligations, and mechanical safety standards. Provincial laws dictate that every vehicle transfer must include a Certificate of Inspection (COI) and specific tax payments like the 7% Retail Sales Tax (RST) for private deals. Whether you are looking to browse our used SUV inventory or scan classified ads, knowing these regulations protects you from financial liability.

Buying a pre-owned vehicle in Manitoba involves more than just kicking the tires and handing over cash. It is a process governed by specific consumer protection laws and insurance requirements unique to our province. In this guide, we break down the complexities of Manitoba Public Insurance (MPI) requirements, tax laws, and the crucial differences between buying from a dealership versus a private seller.

What Is the Essential Manitoba Used Car Buyer’s Checklist?

The essential checklist for Manitoba car buyers focuses on five non-negotiable documents and verifications required for legal transfer. These items ensure the vehicle is safe to drive and free of financial encumbrances before you hand over any money.

- Valid Safety Inspection: Ensure the Certificate of Inspection (COI) is current.

- Lien Check: Verify the car has no outstanding debts.

- Bill of Sale: Must include specific details (make, model, VIN, price).

- Transfer of Ownership Document (TOD): Signed by the previous owner.

- Insurance: Valid Autopac coverage before driving off.

What Are the 7 Steps from Search to Registration?

The journey to vehicle ownership in Manitoba follows a specific 7-step workflow from initial budgeting to the final visit at an Autopac agent. Following this structured path helps buyers avoid missing critical legal steps like the lien search or safety inspection verification.

| Step | Action Item | Key Document/Tool |

|---|---|---|

| 1 | Budgeting | Payment Calculator / Bank Pre-approval |

| 2 | Searching | Inventory Listings / Classifieds |

| 3 | Screening | Carfax / Lien Search |

| 4 | Testing | Test Drive / Pre-purchase Inspection |

| 5 | Verifying | Certificate of Inspection (COI) |

| 6 | Purchasing | Bill of Sale / Transfer of Ownership (TOD) |

| 7 | Registering | Autopac Agent Visit |

Phase 1: How Does Budgeting and Financing Work in Manitoba?

Budgeting for a car in Manitoba involves calculating the total cost of ownership, including taxes (PST/GST or RST), registration fees, and insurance premiums. Since the sticker price is rarely the final price, buyers must account for these additional government-mandated costs immediately.

What Are the True On-the-Road Costs?

The true cost of a vehicle extends beyond the monthly payment to include fuel, maintenance, and insurance premiums that vary by safety rating. With the average used car price in Canada reaching roughly $34,445 according to a 2025 AutoTrader Price Index report, accurate budgeting is essential. Smart shoppers look at the total cost of ownership rather than just the purchase price. For a deeper dive into these hidden expenses, read about The True Cost of Used Car Ownership in Winnipeg.

How Do Manitoba Taxes (PST, GST, RST) Apply?

Taxation rules depend entirely on whether you purchase from a dealership or a private seller. According to the Manitoba Finance Vehicle Taxation Bulletin, the Retail Sales Tax (RST) rate is 7%.

- Dealerships: You typically pay 5% GST and 7% PST.

- Private Sales: You generally do not pay GST, but you must pay the 7% Retail Sales Tax (RST) on the greater of the purchase price or the wholesale value (Gold Book value) when you register the vehicle.

How Can You Secure Financing?

Securing financing before shopping clarifies your budget and strengthens your negotiating position. You can apply for car financing online to see options for various credit situations. Utilizing a digital Payment Calculator allows you to estimate bi-weekly or monthly payments based on interest rates and loan terms. For those with credit concerns, understanding what lenders look for in bad credit applications can improve your approval odds.

Phase 2: How Does Buying from a Dealership Compare to a Private Seller?

Buying from a dealership offers legal protections under the Consumer Protection Act, whereas private sales are “buyer beware” transactions with fewer recourses. The choice determines your level of safety regarding vehicle history disclosure and warranty coverage.

Dealership vs. Private Seller Comparison

| Feature | Dealership | Private Seller |

|---|---|---|

| Consumer Protection | Protected by Act | No “cooling-off” period |

| Tax Structure | 5% GST + 7% PST | 7% RST only |

| Disclosure Laws | Mandatory (>$3k damage) | Buyer responsibility |

| Inspection | COI typically provided | Buyer often arranges |

| Best For | Peace of mind & convenience | Lower upfront price |

What Consumer Rights Apply to Dealerships?

When you buy from a registered dealer, you are protected by the Consumer Protection Act which mandates disclosure of the vehicle’s history. The Manitoba Consumer Protection Office advises that dealers must disclose history, though buyers should not assume a warranty exists unless stated. For more context on the general process, you can review resources on Buying a Used Car in Manitoba.

What Are the Risks of Private Sales?

Buying privately can save money, but it strips away many consumer protections as there is no “cooling-off” period. As noted in community discussions like Buying a Used Car from a Private Seller for Dummies, due diligence is entirely on the buyer. You should also consult the Manitoba Used Car Dealers Association guide on Buying a Used Vehicle Privately to understand the specific risks involved.

Why Choose the Dealership Advantage?

Dealers are legally mandated to disclose past damages exceeding $3,000, use as a taxi or police cruiser, or if the car was rebuilt. This transparency is a key reason many opt for dealerships. To weigh your options further, read about Buying From Dealers vs. Private Sellers in Manitoba.

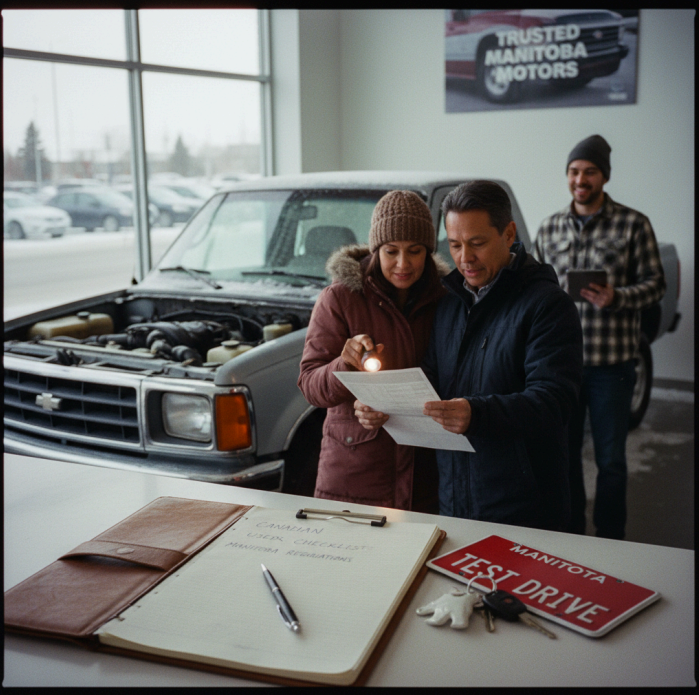

Phase 3: How Should You Conduct Inspections and Test Drives?

A proper inspection and test drive protocol involves verifying the Certificate of Inspection (COI) and physically testing the vehicle’s components under local driving conditions. Never judge a vehicle solely by its appearance, as mechanical issues are often hidden beneath a polished exterior.

What Is the Certificate of Inspection (COI)?

A valid COI confirms that a vehicle met basic safety standards at the time of inspection and is mandatory for registration. Manitoba Public Insurance states that a Certificate of Inspection (COI) is valid for one year to transfer ownership.

Is a COI the Same as a Warranty?

A COI only checks safety items like brakes and lights at a specific moment and is not a guarantee of future reliability. It does not ensure the engine won’t fail, which is why you should schedule vehicle maintenance inspections independently. For a comprehensive look at what is required, check out What You Need to Buy a Used Car in Manitoba.

How Do You Perform a Strategic Test Drive?

Winnipeg roads are notoriously tough, so your test drive should include driving over bumps to check suspension and testing brakes on clear roads. When you book a Test Drive, ensure the heating works for our winter months and the A/C for our humid summers.

Phase 4: What Documentation Is Required for Compliance?

Regulatory compliance requires a signed Transfer of Ownership Document (TOD) and a valid Bill of Sale to legally transfer a vehicle’s title. Without these specific documents, Autopac agents cannot register the car in your name.

Why Is the Transfer of Ownership Document (TOD) Mandatory?

The TOD is found on the back of the seller’s vehicle registration card and acts as the official release of interest in the vehicle. The seller must sign this section and fill in the date and odometer reading; you cannot register the car without it.

How Do You Draft a Valid Bill of Sale?

A proper Bill of Sale protects both parties and must detail the date, price, VIN, and signatures. While a napkin might technically suffice, a formal document is safer. For a checklist of necessary documents, refer to Get Your Ducks in a Row: What You Need to Buy a Used Car in Manitoba.

Why Are Lien Checks Critical?

If you buy a car with a lien on it, the lender can repossess it from you even if you paid the seller in full. Always perform a lien search through the Personal Property Registry System before handing over money.

Phase 5: How Do You Close the Deal and Register?

Closing the deal involves taking your paperwork to an Autopac agent to pay taxes and receive your license plates. This final step legalizes your ownership and ensures your vehicle is insured for the road.

What Happens at the Autopac Agent?

Take your Bill of Sale, TOD, and COI to an Autopac agent to pay your taxes (PST/RST) and set up insurance coverage. You will then receive your license plates and registration certificate.

How Do Trade-In Tax Savings Work?

Trading in a vehicle at a dealership can lower your tax burden because you only pay GST/PST on the difference between the new car’s price and your trade-in value. If you are considering this route, get a Trade-In Appraisal to see how much you can save.

What Are the 5 Common Red Flags?

Common red flags in the Manitoba market include refusal to provide a COI, cash-only demands, or prices that seem significantly below market value. Staying vigilant against these warning signs protects you from curbsiders and scammers.

Identifying Scams and Curbsiders

- Curbsiders: Unlicensed dealers posing as private sellers to avoid regulations.

- Title Washing: Vehicles with “Salvage” titles that have been cleaned up on paper.

- No COI: A seller refusing to provide a COI usually knows the car needs expensive repairs.

- Cash Only: A refusal to accept bank drafts or meet at a bank.

- Price is Too Good: If it is significantly below market value, it is likely a scam.

| Warning Sign | Potential Issue | Implication for Buyer |

|---|---|---|

| Refusal of COI | Hidden Mechanical Issues | The seller likely knows the car requires expensive repairs. |

| Cash Only / No Banks | Fraud or Safety Risk | Avoids a paper trail and verifiable identification. |

| Price “Too Good” | Scam or “Lemon” | Indicates non-existent car or major hidden defects. |

| “Cleaned Up” Paperwork | History Manipulation | Vehicle history may be altered to conceal accidents. |

Driving Away with Peace of Mind

Buying a used car in Manitoba involves navigating a specific set of rules, from the COI to the TOD. However, by following this checklist and understanding the tax and insurance implications, you can secure a reliable vehicle that fits your budget. Remember that preparation is your best negotiation tool.

Browse Quality Inventory and Get Assessed

Ready to find your next vehicle? Skip the uncertainty of the private market. You can contact our team or browse our inventory of High Quality Used Cars For Sale in Winnipeg, MB today. If you are looking to upgrade, start by getting a Trade-In Appraisal and drive away with confidence.

Frequently Asked Questions

How long is a Manitoba Certificate of Inspection (COI) valid?

A COI is valid for one year. It must be valid at the time of transfer to register the vehicle. If the COI expires before you register, you will need to pay for a new inspection at an accredited repair shop.

Do I pay GST on a private used car sale in Manitoba?

Typically, no. In a private sale between individuals, you generally do not pay the 5% GST. However, you are required to pay the 7% Provincial Retail Sales Tax (RST) when you register the vehicle with Autopac.

Can I sell a car in Manitoba without a safety inspection?

Yes, but the buyer cannot register it. You can sell a vehicle “as is,” but the buyer will not be able to get license plates or insurance until they have the vehicle inspected and it passes the COI standards.

What is the difference between PST and RST for cars?

They are essentially the same provincial tax. When you buy from a dealer, it is called PST (7%). When you buy privately, it is collected as RST (7%) at the time of registration. Both amounts go to the provincial government.

Last Updated: January 26, 2026

References

- Manitoba Finance Vehicle Taxation Bulletin – Official government guide on vehicle tax rates.

- Manitoba Public Insurance (COI) – Regulations regarding vehicle safety inspections.

- Manitoba Consumer Protection Office – Information on dealer disclosure requirements.

- AutoTrader Price Index – Market data on Canadian used vehicle pricing.